What is Accelerated Depreciation?

Accelerated depreciation is an accounting method where assets lose value faster in the early years of their useful life and slower in later years. Unlike straight-line depreciation, which spreads the expense evenly, accelerated depreciation recognizes a larger portion of the asset’s cost upfront. This approach reflects how many assets lose their value more quickly when they’re new.

Let’s delve into how it works and why businesses use it.

How Accelerated Depreciation Works

Accelerated depreciation allocates more depreciation expense to the earlier years of an asset’s life. This method aligns with the idea that many assets—such as machinery or vehicles—provide more economic benefits and experience higher usage or wear in their initial years.

The two most common methods of accelerated depreciation are:

- Double Declining Balance (DDB):

- Depreciates the asset at twice the rate of straight-line depreciation.

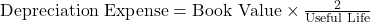

- Formula:

- Sum-of-the-Years’ Digits (SYD):

- Allocates depreciation based on a fraction where the numerator is the remaining useful life and the denominator is the sum of all years of the asset’s life.

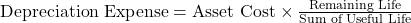

- Formula:

Why Use Accelerated Depreciation?

Businesses use accelerated depreciation for several reasons:

- Tax Benefits: Larger depreciation expenses in early years reduce taxable income, offering immediate tax savings.

- Matching Principle: Aligns higher depreciation with higher revenues when the asset is most productive.

- Reflects Asset Usage: Realistically captures the decline in value for assets that depreciate faster initially.

Example of Accelerated Depreciation in Action

Let’s say a company purchases a machine for $50,000 with a useful life of 5 years and no salvage value.

Using the Double Declining Balance Method:

- Calculate the Straight-Line Depreciation Rate:

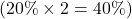

- Straight-line rate =

- Double declining rate =

2. Depreciation Calculations:

Year 1:

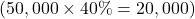

- Depreciation Expense =

- Remaining Book Value =

Year 2:

- Depreciation Expense =

- Remaining Book Value =

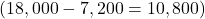

Year 3:

- Depreciation Expense =

- Remaining Book Value =

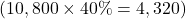

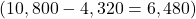

Year 4:

- Depreciation Expense =

- Remaining Book Value =

Year 5:

- Depreciation Expense =

- Remaining Book Value =

This approach front-loads the depreciation, recognizing $20,000 in the first year, compared to $10,000 annually under straight-line depreciation.

Real-World Applications

- Technology Companies: Write off computer hardware quickly as it becomes obsolete.

- Manufacturers: Depreciate machinery that faces intense usage early on.

- Transportation: Account for vehicles that experience significant wear in initial years.

Advantages of Accelerated Depreciation

- Tax Savings: Defers tax liabilities, freeing up cash flow in the short term.

- Reflects Reality: Accurately represents the decline in asset value.

- Supports Growth: Provides more funds for reinvestment during early operational stages.

Disadvantages of Accelerated Depreciation

- Complex Calculations: More intricate than straight-line depreciation.

- Lower Profits Initially: Can reduce reported earnings, which may concern stakeholders.

- Inconsistent Expenses: Creates uneven expense recognition across years.

FAQs About Accelerated Depreciation

Is accelerated depreciation mandatory?

No, businesses can choose the depreciation method that best fits their financial strategy and reporting needs, subject to accounting standards.

What assets are best suited for accelerated depreciation?

Assets that lose value quickly, such as technology, machinery, and vehicles, are ideal candidates for this method.

By understanding accelerated depreciation, businesses can optimize their tax strategies and better align expense recognition with asset usage. It’s a powerful tool for reflecting the economic reality of asset management.