Corporate Tax Strategies for Small Businesses

Introduction

Managing taxes can be one of the most challenging aspects of running a small business. Many entrepreneurs find themselves asking, How can I reduce my corporate tax liability without compromising compliance? Taxation laws can be complex, and without the right strategies, you may end up paying more than necessary. However, with proper planning and smart approaches, you can legally minimize your tax burden and free up resources to grow your business.

This comprehensive guide will explore actionable corporate tax strategies tailored specifically for small businesses. Whether you’re a first-time business owner or looking to refine your existing tax approach, you’ll find practical tips, relatable examples, and tools to streamline your tax management.

Why Tax Strategies Matter for Small Businesses

Tax strategies aren’t just for large corporations. Small businesses can benefit greatly from planning and optimizing their taxes. Here’s why:

- Save Money: Effective tax strategies reduce unnecessary expenses.

- Ensure Compliance: Avoid penalties by staying within legal boundaries.

- Improve Cash Flow: Keep more capital for operational expenses and investments.

- Enhance Growth: Tax savings can be reinvested in marketing, hiring, or infrastructure.

Key Corporate Tax Strategies for Small Businesses

1. Choose the Right Business Structure

Your business structure significantly impacts your tax obligations. Common options include:

- Sole Proprietorship: Simplest structure but not ideal for reducing corporate taxes.

- Limited Liability Company (LLC): Offers flexibility in how income is taxed.

- S Corporation: Allows profits to pass through to owners, avoiding double taxation.

- C Corporation: Suitable for larger small businesses but involves corporate tax and dividend taxation.

Example

Emily runs a bakery and initially operated as a sole proprietor. After consulting a tax advisor, she switched to an S Corporation, which saved her thousands of dollars by avoiding self-employment taxes on part of her income.

Action Step

- Consult a Professional: Seek advice from a tax expert to determine the best structure for your business.

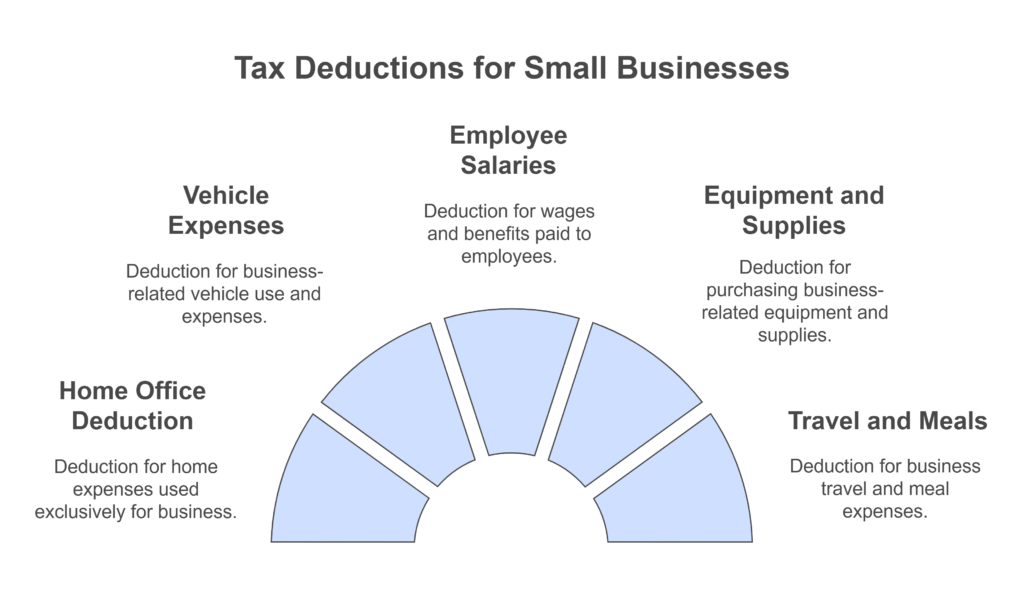

2. Take Advantage of Tax Deductions

Small businesses are eligible for various deductions that can lower taxable income. Common deductions include:

- Home Office Expenses: If you work from home, claim a portion of rent, utilities, and internet.

- Business Equipment: Deduct costs for computers, furniture, and machinery.

- Travel and Meals: Deduct business-related travel and 50% of meal expenses.

- Employee Salaries and Benefits: Reduce taxable income by deducting wages and benefits.

Top 5 Tax Deductions for Small Businesses

Action Step

- Organize Receipts: Use accounting software like QuickBooks to track deductible expenses.

3. Leverage Tax Credits

Tax credits directly reduce your tax bill and are often more valuable than deductions. Popular credits include:

- Research and Development (R&D) Credit: For businesses investing in innovation.

- Work Opportunity Credit: For hiring employees from target groups.

- Energy Efficiency Credit: For investing in energy-efficient equipment.

Example

A tech startup invested in developing a new app and claimed the R&D credit, reducing their tax bill by $10,000.

Action Step

- Research Eligibility: Consult the IRS website or a tax professional to identify applicable credits.

4. Defer Income and Accelerate Expenses

Adjusting the timing of income and expenses can optimize your tax liability.

- Defer Income: Delay receiving payments until the next tax year.

- Accelerate Expenses: Make advance payments for supplies or services.

Example

John’s consulting firm deferred invoicing clients until January, reducing taxable income for the current year.

Action Step

- Plan Year-End Finances: Work with an accountant to manage income and expenses strategically.

5. Invest in Retirement Plans

Contributing to retirement plans benefits both you and your employees while reducing taxable income. Options include:

- SEP IRA: Simplified plan for small businesses.

- 401(k): Allows higher contribution limits.

- Simple IRA: Easy to set up with lower administrative costs.

Comparison of Small Business Retirement Plans

| Plan | Contribution Limits | Tax Benefits | Eligibility Criteria |

|---|---|---|---|

| SEP IRA | Up to 25% of compensation or $66,000 (2024 limit) | Contributions are tax-deductible for employers; grows tax-deferred. | Available to any business owner with employees. |

| SIMPLE IRA | $15,500 (under 50); $19,000 (50 and older) (2024 limit) | Contributions are tax-deductible; easy to set up and administer. | Employees earning at least $5,000 annually. |

| 401(k) | $22,500 (under 50); $30,000 (50 and older) (2024 limit) | Employee contributions reduce taxable income; employer matches may qualify as deductible. | Any employee meeting the employer’s criteria, typically age and service. |

| Solo 401(k) | Same as 401(k) plus employer contribution up to $66,000 (2024 limit) | Tax-deductible contributions; tax-deferred growth. | Self-employed individuals with no employees (except spouse). |

Action Step

- Set Up a Plan: Explore retirement plan options and consult a financial advisor.

6. Keep Accurate Records

Accurate record-keeping is essential for identifying deductions, avoiding audits, and ensuring compliance.

Tips for Effective Record-Keeping

- Use Accounting Software: Tools like Xero or FreshBooks simplify tracking.

- Organize Receipts: Digitize paper receipts for easy access.

- Maintain Detailed Logs: For mileage, travel, and business meetings.

Question: How do you currently manage your business records? Could adopting new tools improve efficiency?

7. Consider Hiring a Tax Professional

Tax laws are constantly changing. A tax professional can:

- Identify overlooked deductions and credits.

- Provide strategic advice tailored to your business.

- Handle IRS communications and audits.

Example

A retail store owner saved $15,000 by working with a CPA who identified additional deductions.

Action Step

- Find a Specialist: Look for a CPA or Enrolled Agent with experience in small business taxation.

Test Your Knowledge

Question: Which tax strategy involves delaying income until the next tax year?

- A) Accelerate Expenses

- B) Defer Income

- C) Claim Credits

- D) Deduct Salaries

Get Answer

Correct Answer: B) Defer Income

Key Takeaways

- Small businesses can benefit significantly from strategic tax planning.

- Choosing the right business structure and leveraging deductions and credits are foundational steps.

- Accurate record-keeping and professional advice can maximize savings and ensure compliance.

- Investing in retirement plans and timing income and expenses effectively are advanced strategies worth considering.

Conclusion

Ready to optimize your taxes? Download our free “Small Business Tax Checklist” and explore our Corporate Tax Tutorials for more in-depth guidance. Stay proactive, and let smart tax strategies fuel your business growth!